closed end credit trigger terms

The amount or percentage of the down payment. Triggering terms are words or phrases that must be accompanied by a disclosure when theyre used in advertising.

Behind Closed Doors Inside The Loan Application Process

Ii The terms of repayment which reflect the repayment obligations over the full term of the loan including any balloon payment.

. A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a specific. Friday March 11 2022. Triggered Terms 102616 b.

Provide the credit bureau with any credit reports received from other bureaus within the last sixty 60 days. Ii The number of payments or period of repayment. Iii The annual percentage rate using that term and if the.

If an institution used triggering terms 102616b opens new window or the payment terms were set forth for a HELOC did the advertisement also include clearly and conspicuously. You typically have to take some. The dollar amount of a downpayment or a statement of the downpayment as a percentage of the price requires further information.

Closed end loan trigger terms. Closed End Credit is defined 2262 as credit other than open-end credit. Advertised rates must be stated in terms of an annual percentage rateas defined in 102622.

Open-end credit is defined as credit extended under a plan in which. The amount or percentage of the. 22624 - Closed end credit.

Provide the consumer with the contact information of three 3 dispute. Triggering terms for closed-end loans. The amount of any finance charge.

If any of the following terms is set forth in an advertisement the advertisement shall meet the requirements of paragraph d 2. If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2. Even though state or local law permits the use of add-on.

If any triggering term is used in a. Open-end credit products such as HELOCs are. For example if an advertisement for credit secured by a dwelling offers 300000 of credit with a 30-year loan term.

For example financing costs less than 500 less than 200 interest or 250 financing. If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement.

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

What Is A Triggering Term Awesomefintech Blog

Lines Of Credit Types How They Work How To Get Them

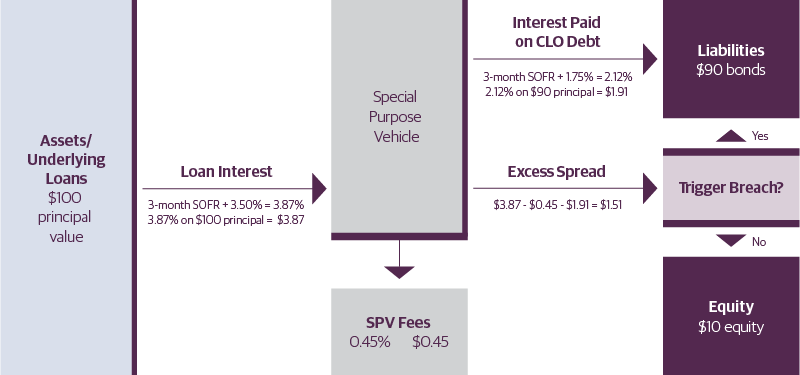

Leveraged Loan Primer Pitchbook

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

What Is Closed End Credit Cash 1 Blog News

What Is A Triggering Term Awesomefintech Blog

What Is A Triggering Term Awesomefintech Blog

The Abcs Of Asset Backed Securities Abs Guggenheim Investments

Using A Home Equity Loan For Debt Consolidation

Closed End Loan Advertising Triggers The Works Blog By Policyworks

What Is Closed End Credit Cash 1 Blog News

A Refresher On Triggering Events Impacting The Revised Loan Estimate Wolters Kluwer

What Is Closed End Credit Experian

What Is A Triggering Term Awesomefintech Blog

What Is Closed End Credit Cash 1 Blog News

Debt Relief Understand Your Options And The Consequences Nerdwallet